NY RP-425-Rnw 2018-2024 free printable template

Show details

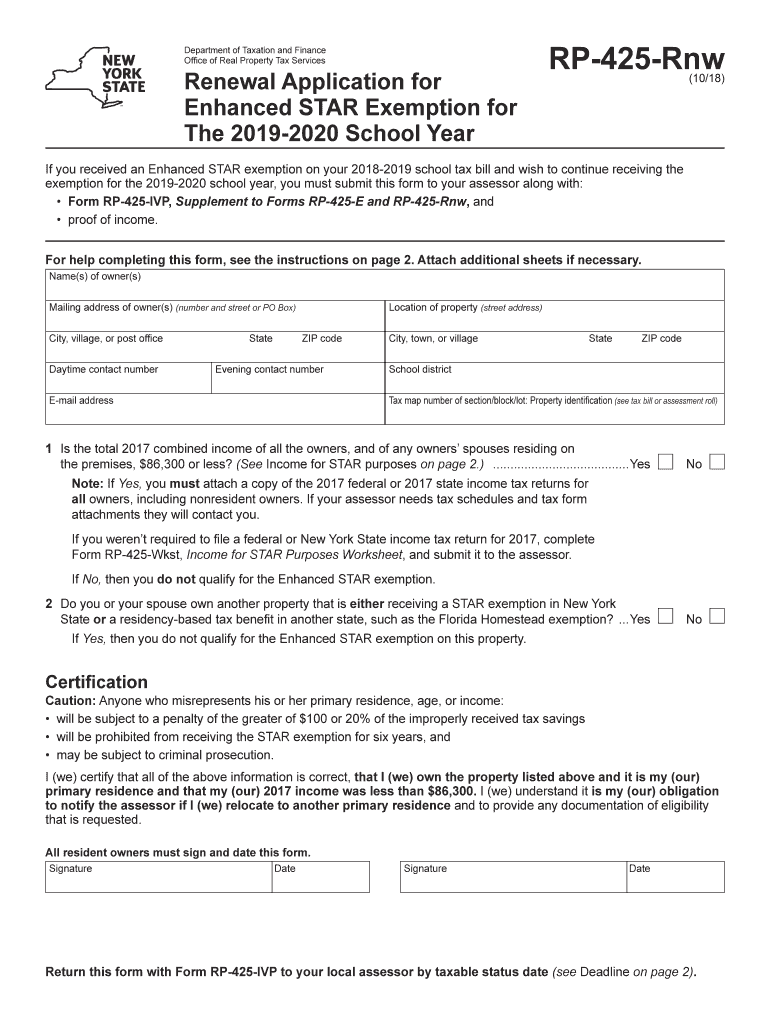

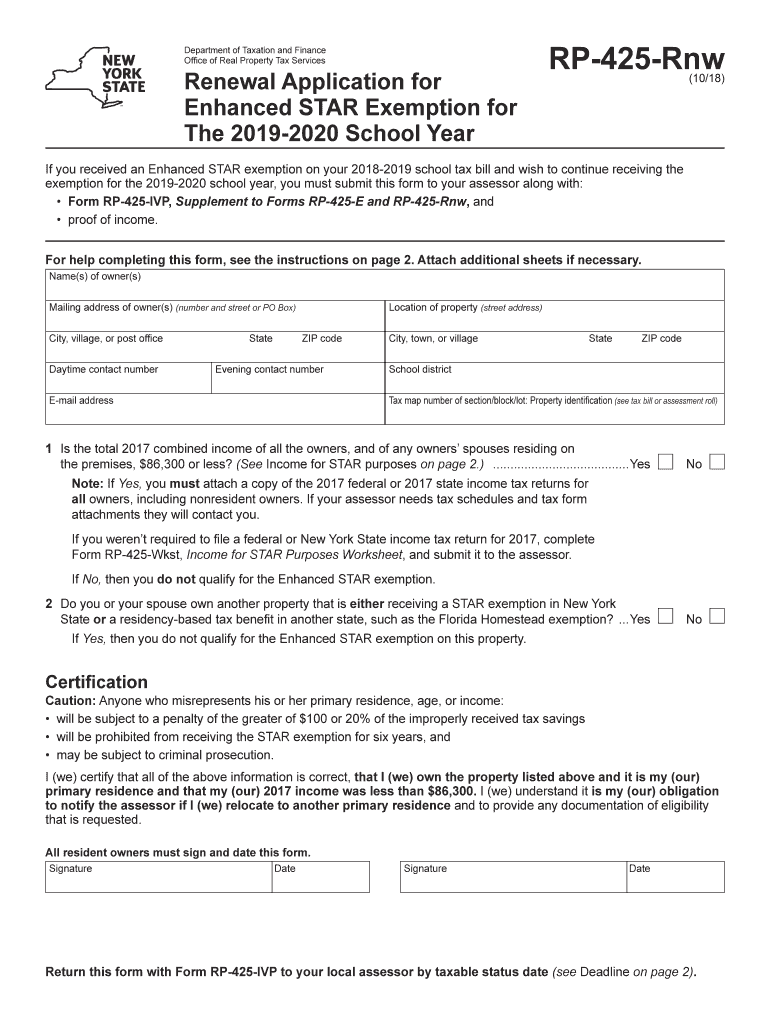

Signature Date Clear Form RP-425-Rnw 6/13 back General information The New York State School Tax Relief STAR Program provides an exemption from school taxes for owner-occupied primary residences where the combined 2012 income of the owners and spouses who reside on the property does not exceed 500 000. RP-425-Rnw New York State Department of Taxation and Finance Office of Real Property Tax Services 6/13 Renewal Application for Enhanced School Tax Relief STAR Exemption Dear Property Owner You...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your star school tax relief form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your star school tax relief form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit star school tax relief online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit star school tax relief. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

NY RP-425-Rnw Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out star school tax relief

How to fill out star school tax relief

01

To fill out star school tax relief, follow these steps:

02

Gather all the necessary documents such as income statements, property tax bills, and proof of residency.

03

Visit the official website of the tax department in your state or contact your local tax office to obtain the star school tax relief application form.

04

Read the instructions carefully and fill out the application form accurately and completely.

05

Attach all the required documents along with the application form.

06

Double-check all the information and documents before submitting the form.

07

Submit the completed application form and supporting documents to the designated tax office or submit them online as per the instructions provided.

08

Wait for the tax office to review your application and process the star school tax relief.

09

If your application is approved, you will receive the tax relief benefits for the specified tax year. If there are any issues or discrepancies, the tax office may contact you for further clarification or documentation.

10

Keep a copy of the submitted application and documents for your records.

11

Note: The specific process and requirements may vary depending on your state or local tax regulations.

Who needs star school tax relief?

01

Star school tax relief is designed for individuals who meet certain criteria and are looking to reduce their property tax burden.

02

Generally, those who may benefit from star school tax relief include:

03

- Homeowners with primary residences who are facing financial hardship and want to lower their property tax payments.

04

- Elderly individuals or senior citizens who may be on a fixed income and find it challenging to afford their property taxes.

05

- Disabled individuals or veterans who may qualify for special exemptions or deductions.

06

- Low-income households or families who meet the income requirements set by their state or local tax department.

07

It's important to note that the eligibility criteria and requirements for star school tax relief can vary from state to state. Checking with your local tax office or visiting their website will provide you with the most accurate and up-to-date information regarding who may qualify for this relief.

Fill form : Try Risk Free

People Also Ask about star school tax relief

What age is senior tax freeze in Illinois?

Who is exempt from property taxes in Illinois?

How can I reduce my property taxes in Illinois?

How do I get an Illinois tax exemption certificate?

Who qualifies for homeowners exemption in Illinois?

At what age do seniors stop paying property taxes in Illinois?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send star school tax relief for eSignature?

To distribute your star school tax relief, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I edit star school tax relief on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing star school tax relief right away.

How can I fill out star school tax relief on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your star school tax relief by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your star school tax relief online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.